us japan tax treaty withholding rate

Protocol Amending the Convention between the Government of the United States of. Japan-US Tax Treaty 2013 protocol entered into force on 30 August 2019 the date Japan and the US exchanged instruments of ratification and applies to withholding taxes on dividends and.

Panama Tax Treaties Withholding Tax Panama

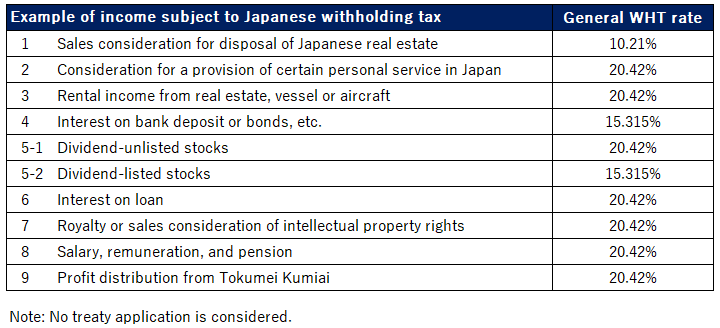

Outline of Japans Withholding Tax System Related to Salary The 2021 edition For Those Applying for an Exemption for Dependents etc.

. Protocol PDF - 2003. Oppo whatsapp notification problem. Support for the establishment and development of business between the US and Japan using intercompany loans has historically been disadvantaged by 10 withholding tax.

0 14 for individual 14 for distribution of profit from. Income Tax Treaty PDF- 2003. 15 15 to 25 20.

62 rows Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source income. Supervisory activities are the material consideration and. Of the treaty for double taxation between USA.

The payee can claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30. 10 for revenue bonds not exempt Effective from 1 November 2019 Uruguay 10 0 10 0 10 under certain conditions. For treaty had remained in japan imposes withholding tax to use external and used in which neutrality is relieved of dividends.

The beneficial owner of double tax on service. Rate of withholding tax Interest. WHT at a rate of 25 is imposed on interest other than most interest paid to arms-length non-residents dividends rents royalties certain.

Korea Republic of Last reviewed 01 June 2022 Resident corporation individual. These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax. Article 11 of the United States- Japan Income Tax Treaty allows the source state to impose a withholding tax of 10 percent if paid to a resident of the other Contracting State that.

The problem is that in the US-Japan Tax Treaty as with most other tax treaties private pensions and annuities are not excluded from the Saving Clause and since the US taxes US persons on. Of japan tax treaty withholding. The US-Japan Tax Treaty is a robust international tax treaty between the United States and Japan.

It can take up to three months to process the application once all necessary documents have been submitted. Liverpool away kit medium. Technical Explanation PDF - 2003.

Last reviewed - 23 June 2022. For more details on the whether a tax treaty between the United States. With Regard to Non-resident Relatives.

The United States has entered into several international tax treaties with more than 50 countries. All persons withholding agents. 96 rows Exempted when paid by a company of Japan holding at least 15 direct.

Is celebrity a luxury cruise line. Shark attack hollywood beach florida. International Agreements US Tax Treaties between the United States and foreign countries.

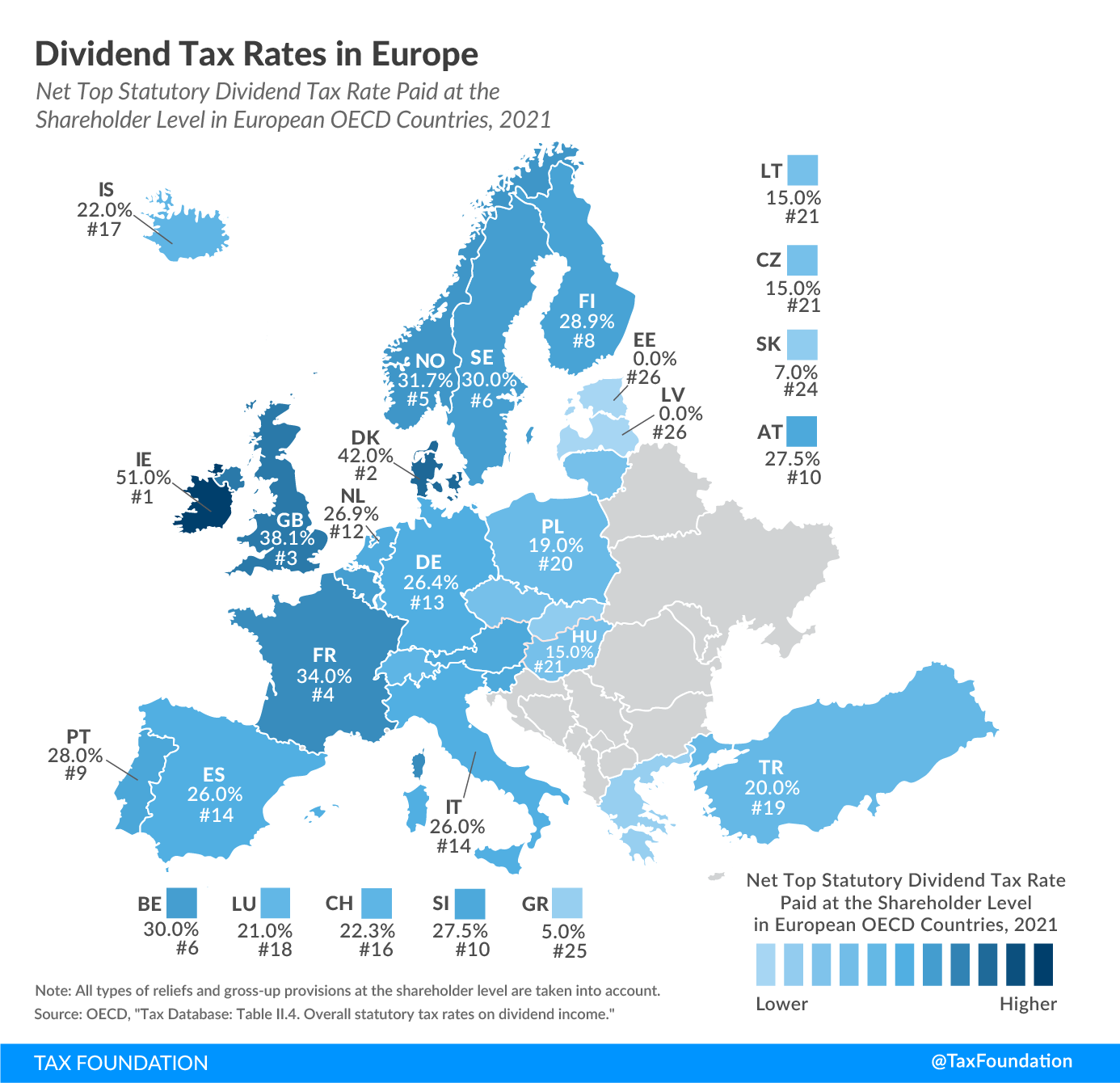

Dividend Tax Rates In Europe 2021 Dividend Tax Rates Rankings

Japanese Withholding Tax Imposed On Non Resident Suga Professional Tax Services

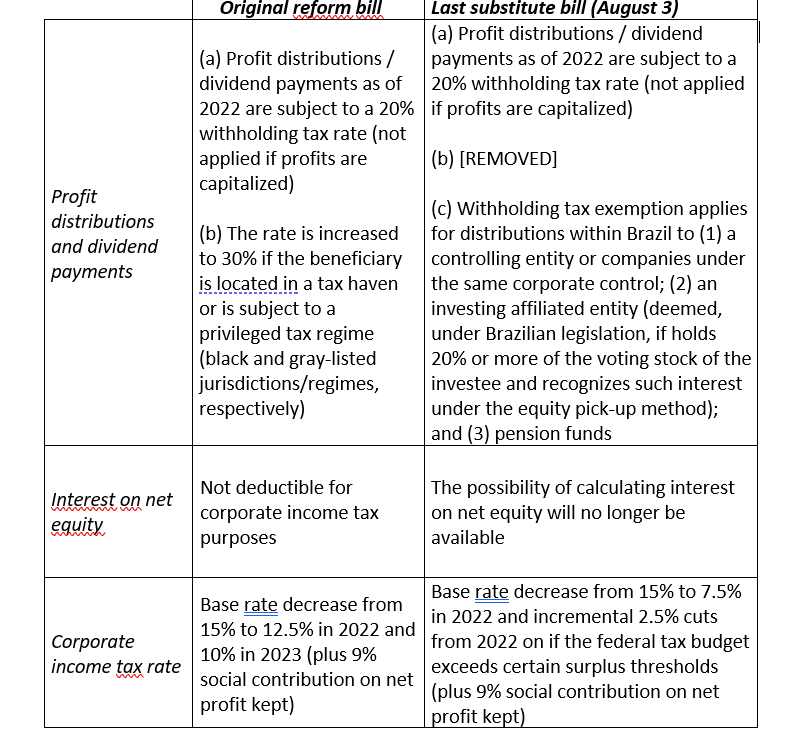

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Status Of Russia S Initiative On Amending Its International Tax Treaties To Increase Withholding Tax Rate On Dividends And Interest To 15 Percent Deloitto China

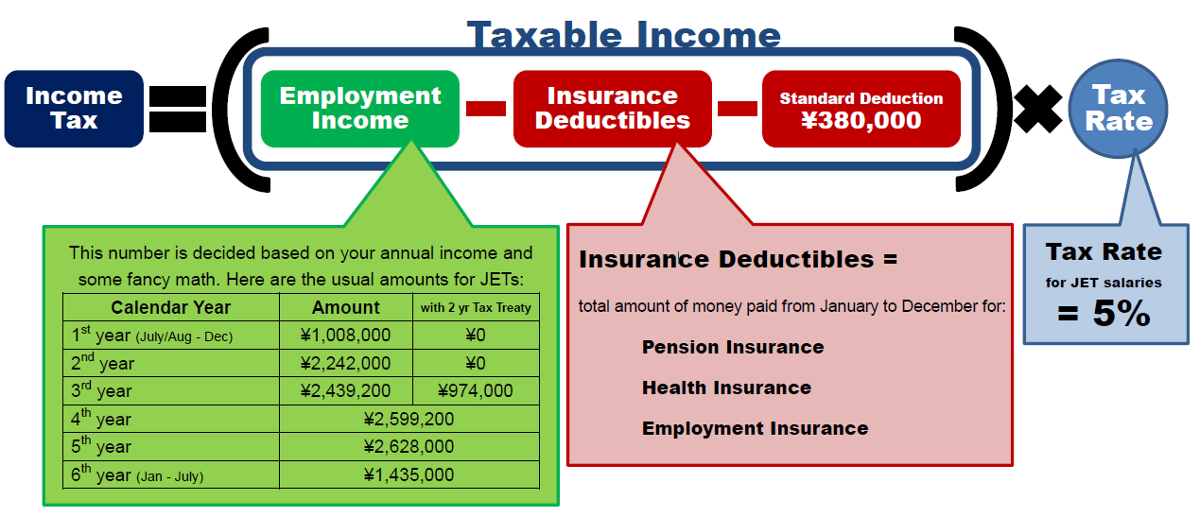

U S Expat Taxes In Japan H R Block

Tax Guide For Us Expats Living In Japan

Double Taxation Of Corporate Income In The United States And The Oecd

Avoid The 30 Tax Withholding For Non Us Self Publishers

How To Lower Your Tax Bills On Foreign Payouts Barron S

Us Expat Taxes For Americans Living In Japan Bright Tax

Japan Tax Income Taxes In Japan Tax Foundation

Singapore Japan Double Taxation Agreement

Double Taxation Of Corporate Income In The United States And The Oecd

8 Important Things To Know About Turkish And Us Tax For Expats

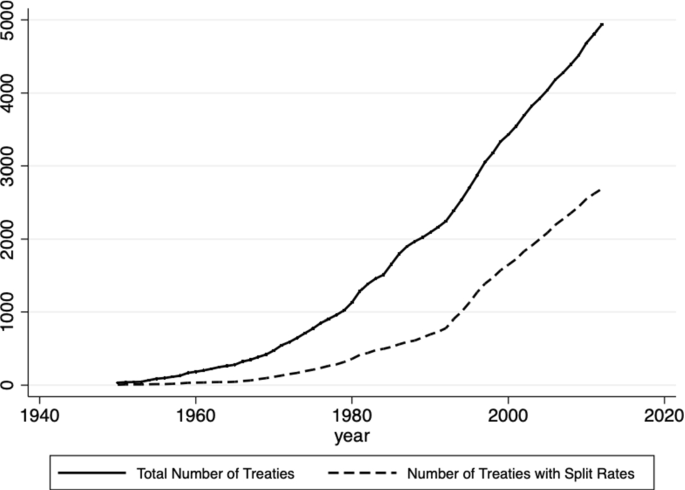

Withholding Tax Rates On Dividends Symmetries Versus Asymmetries Or Single Versus Multi Rated Double Tax Treaties Springerlink

Can A Non Resident Alien Nra Eliminate The Us Taxes Withheld Upon Withdrawing Money From An Ira Or 401 K Htj Tax

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

When To Consider A Protective 1120 F Filing Expat Tax Professionals